America’s 50 different states have 50 different tax codes. This variation lets states experiment and learn from each other which policies work best. Laboratories of democracy as our founding fathers intended. Each year, the nonpartisan Tax Foundation ranks states based on their business tax climate. This ranking takes into account state tax rates, the different kinds of state taxes, and whether or not the state taxes cause residents to forego economic activity.

The Tax Foundation ranks Wisconsin’s tax climate as 43rd in the nation. This isn’t very good and is the same ranking the state held last year. There was some reform of business taxes last session, and Wisconsin still ranks toward the bottom of the list because we have the fifth worst individual tax rate and a state-level alternative minimum tax, which complicates the filing process for taxpayers and makes some pay more.

The best business tax climate states are Wyoming, South Dakota, Nevada, Alaska, and Florida. These states generally have low income tax rates and in many cases do not have one or more of the major types of taxes (corporate, individual income, or sales). Wyoming, South Dakota, and Nevada, for example, don’t have corporate or individual income taxes.

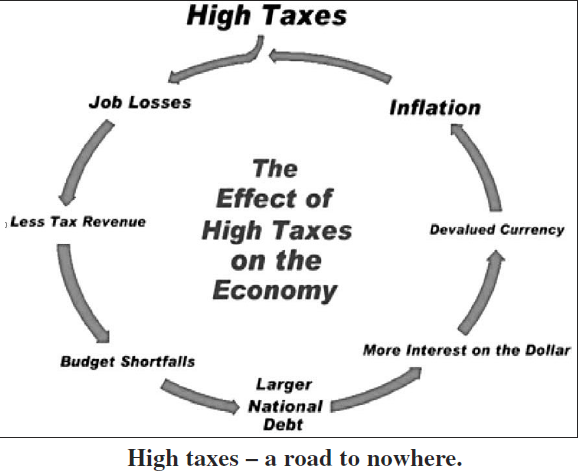

The worst business tax climate states are Rhode Island, Vermont, California, New Jersey, and New York. Taxes in these states are high, complex, and cause businesses and consumers to alter their behavior in order to avoid taxes.

The worst business tax climate states are Rhode Island, Vermont, California, New Jersey, and New York. Taxes in these states are high, complex, and cause businesses and consumers to alter their behavior in order to avoid taxes.

It is clear taxes are a real part of the job climate in different states. Liberals argue that lower taxes will not create jobs - they think more government spending will. Modestly lowering tax rates is a positive step in the right direction for Wisconsin. Putting more people back to work means less dependence on taxpayer funded government programs like Medicaid, food stamps and unemployment insurance and more taxes being paid. This is better for everyone.

Last year, Republicans in the Wisconsin Legislature worked with Governor Walker to change the business tax structure in Wisconsin. Manufacturers who chose to do business in Wisconsin were given a tax credit. Companies who created jobs were given a tax deduction. For businesses in states like Illinois, where taxes were raised by an astonishing 66%, Wisconsin offered an incentive to relocate to our state. Solid, pro-business legislation that we passed last session helped move Wisconsin’s ranking from 41st to the 20th best state to do business in, in spite of our poor tax climate.

Last year, Republicans in the Wisconsin Legislature worked with Governor Walker to change the business tax structure in Wisconsin. Manufacturers who chose to do business in Wisconsin were given a tax credit. Companies who created jobs were given a tax deduction. For businesses in states like Illinois, where taxes were raised by an astonishing 66%, Wisconsin offered an incentive to relocate to our state. Solid, pro-business legislation that we passed last session helped move Wisconsin’s ranking from 41st to the 20th best state to do business in, in spite of our poor tax climate.

Business taxes have improved in Wisconsin, and families need tax relief too. That’s why Governor Walker’s budget proposes modestly lowering individual tax rates in Wisconsin, a measure the legislature will take up later this session.